Small business owners know better than anyone that back office operations can become a full-time job of its own. That’s why we decided to partner with inDinero, a company that provides cloud-based accounting software along with expert finance professionals to help you scale your business.

Why We Partnered with inDinero

Justworks wants to provide small businesses with everything we can to help you run your team, while still keeping the integrity of our core offerings.

And much like Justworks, inDinero provides outsourcing services and tools to streamline running your business, so that you can focus on what matters.

We sat down with Molly Siems, Director of Business Development at Justworks, who drove this partnership with the philosophy of bettering small business operations in mind. She discussed the partnership more in depth and what opportunities it may offer Justworks members.

Q&A with Molly Siems

Can you give a summary of what inDinero does for its clients?

Indinero has a cloud-based accounting platform for small businesses that takes care of bookkeeping, taxes, financial statements, reporting, and payments. It’s a software platform plus services. It’s more comprehensive than QuickBooks, but it’s more tech forward than a human accountant. inDinero is at that sweet spot in the middle ground.

Why has Justworks decided to partner with inDinero?

inDinero is doing the same thing in the accounting industry that we’re doing in the HR industry. They are the tech-forward solution for small businesses that’s transparent and easy to use, all with a great user experience. Using inDinero also tends to be more affordable than hiring a full-time controller.

What made inDinero stick out from other potential partners?

They’re more comprehensive than the lightweight solutions out there and have an enterprise package, which is useful for growing businesses and venture-backed startups.

For example, their enterprise package provides GAAP (generally accepted accounting principles) financial statements, accrual accounting, board packages, and more robust financial reporting tools. It’s way more than you would get if you were using DIY accounting software, and inDinero has 150 accounting professionals on staff.

When can Justworks members start using inDinero?

You can start using it right away! If you’re interested, you can reach out to them today.

Is there a discount involved?

Yes! All Justworks members will get 30% off onboarding at inDinero and 30% off the first three months.

Is there anything else you’d like to add?

inDinero is a great partner because where our platform ends, theirs begins. We do payroll taxes, they do corporate taxes. We handle HR paperwork, paying employees, and providing their benefits, they handle the bookkeeping. It’s a logical extension of Justworks’ services, and there’s a lot of overlap between our customer base. If you work with both of us, you’re pretty much automating almost your entire back office and getting a lot scalability and efficiency.

At the end of the day, we can focus on making our HR, compliance, and suite of benefits the best it can be for Justworks members, and still give you your full back office operations as well.

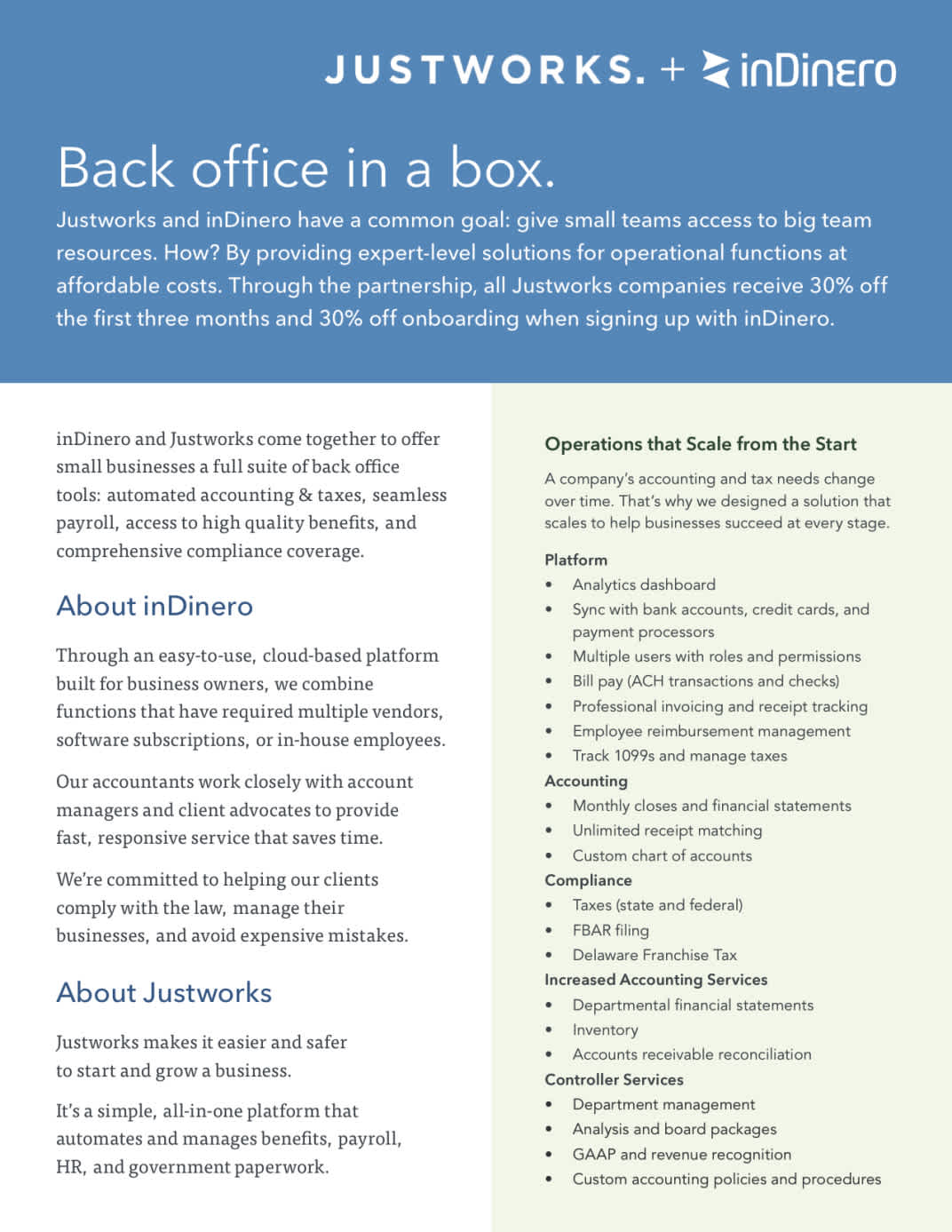

Curious about all the features inDinero provides? Feel free to check out inDinero’s informational sheet below, which explains the company’s offerings.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.