Over the past couple of months, we’ve been quietly rolling out a few key changes to improve our payroll and payment features. As always, we’re aiming to quickly respond to your pain points and support an increasingly flexible scope of payments.

Cumulative Withholding for Bonuses

When employees receive a bonus, it can be taxed in one of two ways: a flat tax of 25% or at a “cumulative rate.”

While the flat tax is appropriate for one-off bonuses, it can cause a tax burden for employees that are regularly paid through supplemental pay and whose income is highly dependent on these bonuses.

With cumulative withholding, we’re able to withhold at the projected rate over the time period.

Now when you select supplemental pay and then bonus in the app, you’ll be able to select either a flat 25% withholding or cumulative withholding. If you select cumulative, you’ll be able to select whether this is a one-off, monthly, quarterly or yearly bonus. This allows us to estimate the taxes accordingly and withhold the right amount.

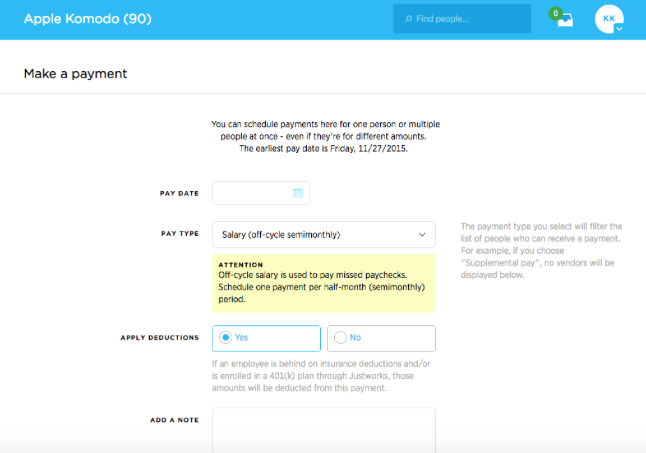

Deductions From Off-Cycle Salary Payments & Commissions

When an employee is contributing to a 401(k) or paying for healthcare or life insurance, they’re eligible to make deductions from their pre-tax salary.

Up until recently, we only supported deductions for regularly scheduled payroll, but not for off-cycle salary payments or commissions.

With our new releases, we can now withhold deductions from both these kinds of payments. This will be especially relevant if you have employees who are frequently paid with off-cycle salary or whose compensation is heavily based on commissions.

Employee Taking Owner’s Draws

We’ve heard from multiple companies that there are full-time employees at S-corporations who are also eligible for owner’s draws.

Until recently, we only supported owner’s draws for employees categorized as owners, but moving forward full-time employees will also be able to receive owner’s draws.

Warning Feature Around 1099 Payments

In the past, we’ve had a few instances where employers have mistakenly paid their W2 employees with contractor pay. Doing so can lead to tax complications and to employees receiving a 1099 at the year end.

While there are scenarios where this is necessary, most of the time employers mean to pay their W2 employees supplemental pay and mistake it with contractor pay.

Now, when you try to make a 1099 payment to a W2 employee, you’ll see a warning and you’ll need to check a box confirming you’d like this payment to be a contractor payment. As a helpful FYI, a W2 employee should only receive 1099 payment in the event that the work they’re doing meets the criteria for 1099 work. **Here’s a quick primer about when that applies.

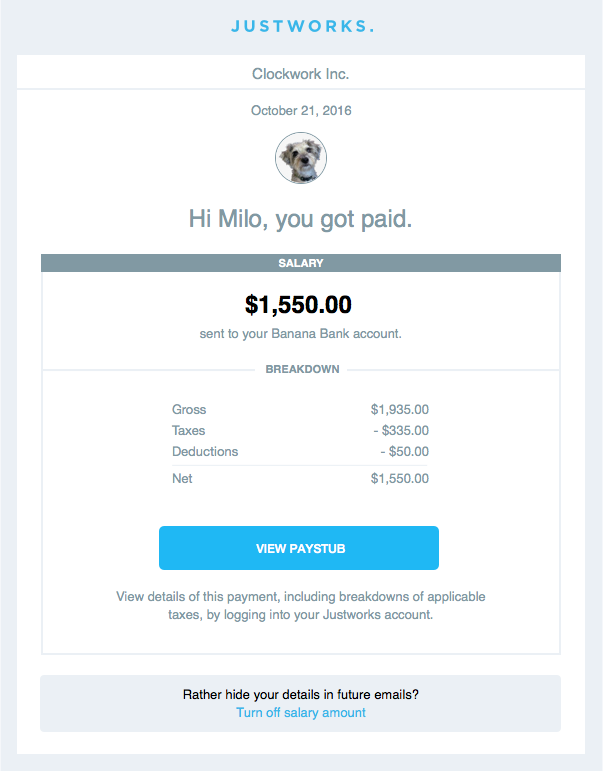

New Payments E-mails

We’ve recently rolled out some updated payment emails! The new emails disclose what kind of payment it is (salary, supplemental, reimbursement, etc) and allow the recipient to decide whether they’d like to see the amount in the email. If they’d like to add the monetary amounts to their email, they can turn that on directly from the email.

This new email will make employees’ lives easier by allowing them to track their payments without needing to log into either their bank accounts or Justworks to confirm the amounts. We’re excited to make both employees and managers lives easier when it comes to tracking their personal finances.

We’re chipping away at payroll and payments features to meet all your payments needs.

As we continue to roll out these features to support flexible payments schemes, please reach out with different payments needs you might have. We’d love to hear from you at [email protected].

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.