2022 Health Insurance Knowledge Snapshot

Benefits selection should be empowering. Yet, according to the Health Insurance Knowledge Snapshot commissioned by Justworks and conducted by Harris Poll, this is often not the case. Many employed adults don’t understand their health insurance offerings as well as they think they do.

Key survey insights .

The Harris Poll survey of over 1,000 employed American adults shows that people don’t know what they don’t know when it comes to health insurance, that they wish others would help them make their own decisions, and that health insurance—or perceptions about it—can be a contributing factor when employees leave or look for jobs. In particular, when looking across age groups, younger employees are more stressed and less confident in their health insurance decisions.

The health insurance "knowledge gap" is wide.

While the majority of employed Americans (82%) feel that they are knowledgeable about the health insurance enrollment process, including over a third (39%) who feel they are very knowledgeable, more than half (53%) do not feel they are getting the most out of the health insurance options available to them. A similar proportion (54%) don’t know the full scope of what their current health insurance offers them.

Further, many employed adults in the US actually misunderstand basic facts about health insurance despite high levels of self-reported knowledge. Specifically:

Three quarters of US employed adults (75%) said they believe or are not sure if they can keep Flexible Spending Accounts (FSAs) even if they leave their current job.

Nearly two-thirds (63%) said they believe or are not sure if they could decide to make changes to their health insurance plan or dependent coverage mid-year after enrolling.

Over half (59%) are not aware that they can only enroll in a Health Savings Account (HSA) if they are enrolled in a High-Deductible Health Plan (HDHP).

Over half (54%) believe or are not sure if a deductible is how much your insurance will pay for various health services.

Employees are not sure where to turn.

When it comes to benefits enrollment, employed Americans are unsure about who to turn to if they have questions. Many times, they fall back on selecting the same insurance every year, potentially undercutting employers' efforts to improve the enrollment experience by adding new plans or offer coverage at new price points. This lack of knowledge, paired with discomfort reaching out to HR, may lead employees to miss out on their available benefits or reach out to sources that lack knowledge.

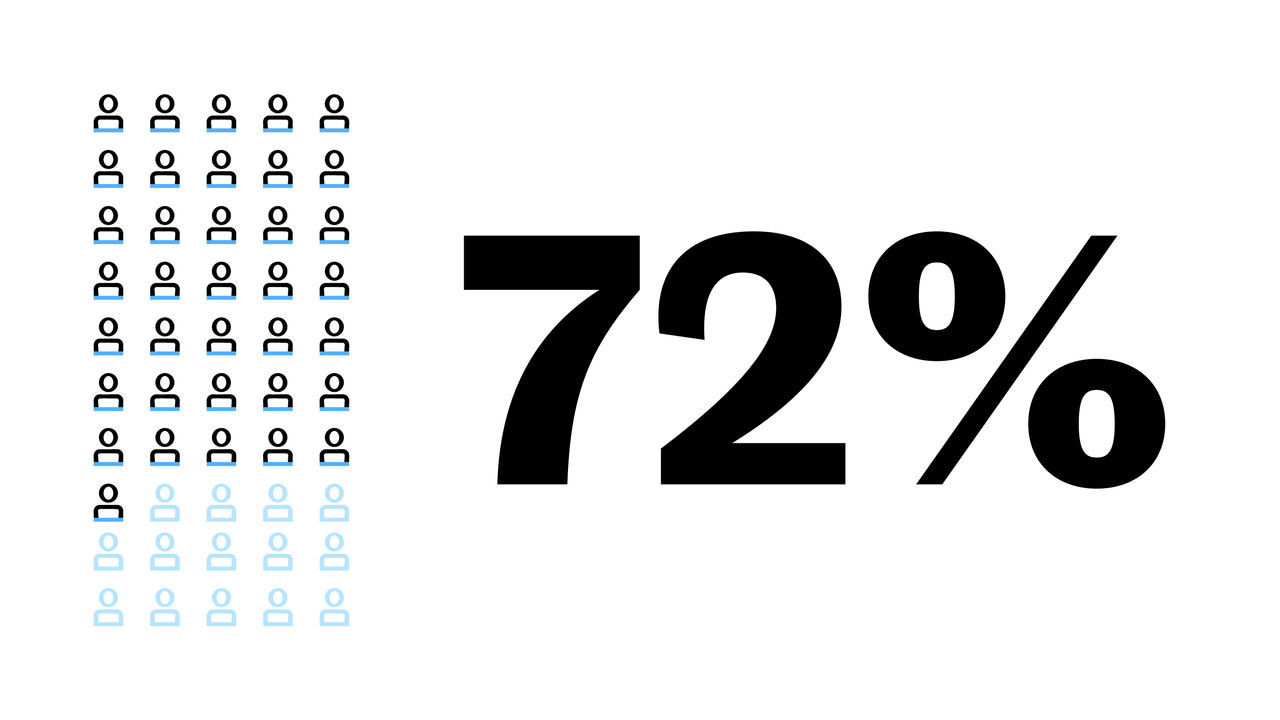

Nearly three-quarters of employees (72%) said they wish someone would tell them what the best health insurance for their unique situation is. In addition, 44% of employed U.S. adults said they feel uncomfortable asking their HR representative questions about health insurance enrollment, while 47% said they call their friends or family members for help when enrolling in health insurance.

Nearly two-thirds (62%) of employed Americans said they don’t usually change their health insurance selections year over year because it’s too stressful, and nearly half (49%) feel pressure to select the most expensive health insurance option to ensure they have the coverage that they need.

The health insurance decision-making process makes Americans emotional .

Those who partake in the enrollment process express a range of positive feelings, from protected (44%), to confident (39%), excited (30%), or empowered (26%) while others can have negative feelings of being overwhelmed (29%), stressed (24%), uncertain (22%), confused (19%), frustrated (18%), or defeated (5%).

Perceptions about health insurance can impact retention.

Given the current labor market, understanding health insurance is important. Among the employed Americans surveyed, 66% said that they were looking actively for a new job, or were open to a new role. In some cases, health insurance benefits outweigh pay as a priority, as 78% of US employees say that having health insurance that meets their specific needs is important to them when looking for a new job, and 64% say that they would be willing to sacrifice some pay for better health insurance. In addition, nearly two-thirds (63%) say that their company’s health insurance offerings impact how much they want to keep working there.

Employees who are either actively looking or open to a new job (58%) are more likely to say they don’t feel they are getting the most out of the health insurance options available to them compared to their peers (44%), highlighting the impact of benefits education and an enrollment experience that ensures employees feel secure and valued.

Those who are actively looking for a new job (73%) are more likely than those who are just open to a new job (63%) or those who are neither looking nor open to a new job (62%) to say that they would be willing to sacrifice some pay for better health insurance if they were looking for a new job.

Specific group findings by age.

We also found that knowledge gaps may be costing employees money — particularly younger employees. Younger people tend to be less knowledgeable about health insurance, less comfortable asking questions of their HR reps, less clear on what their current health insurance offers them, and more likely to feel pressure to select the most expensive health plan to ensure they have the coverage that they need.

Younger employed adults are more likely to incorrectly answer or to be unsure about some basic facts about health insurance — specifically the definition of a deductible (18-34 67%; 35-44 71%) — versus older adults aged 45 and over (aged 45-54 41%; 55-64 26%; 65+* 24%).

However, younger employees are more likely to be uncomfortable asking their company’s HR rep questions about health insurance enrollment (18-34 48%; 35-44 54%) versus older adults aged (45-54 (38%); 55-64 (33%); 65+* 19%)).

Younger employees are more likely to be unaware of the full scope of what their current health insurance offers them (18-34 (58%); 35-44 (64%)) versus older adults (aged 45-54 (46%); 55-64 (45%); 65+* (41%)).

Younger employees involved in their health insurance decisions also are more likely to feel pressure to select the most expensive health insurance option to ensure they have the coverage that they need (18-34 (55%); 35-44 (59%) versus older adults aged 45-54 (40%); 55-64 (37%); 65+* (30%)).

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of Justworks from June 9-13, 2022 among 2,021 U.S. adults ages 18 and older, including 1,040 respondents who are employed either full time or part time. For complete survey methodology, including weighting variables and subgroup sample sizes, contact us.